Benchmark stock indices, Nifty and Sensex today, witnessed a sharp decline of around 1% on Thursday, driven by significant selling pressure in banking and auto shares. This downturn was fueled by heightened uncertainty surrounding the timing of potential interest rate adjustments following the Reserve Bank of India’s (RBI) latest monetary policy decision.

The 30-share BSE Sensex experienced a notable setback, plunging by 723.57 points or 1% to settle at 71,428.43, erasing all early gains. Similarly, the broader Nifty index shed 212.55 points or 0.97% to settle at 21,717.95.

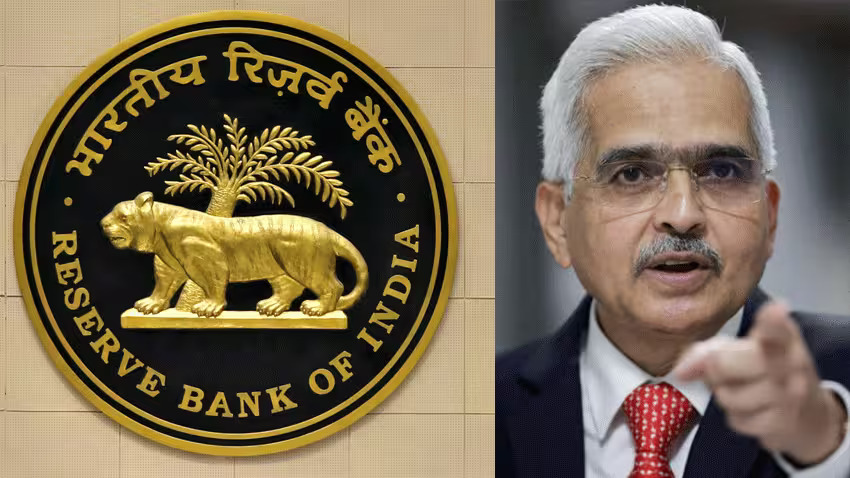

The RBI Monetary Policy Committee opted to maintain the policy rate unchanged for the sixth consecutive time, citing global uncertainty and the imperative to stabilize retail inflation at 4%. RBI Governor Shaktikanta Das affirmed the decision, emphasizing the need to monitor the evolving macroeconomic landscape closely.

Despite an improved GDP growth forecast for FY25, the RBI remains vigilant regarding inflation and banking liquidity. The delay in the transmission of cumulative 250 bps and persistent inflation above the target level has contributed to ambiguity regarding the timing of potential interest rate cuts.

Vinod Nair, Head of Research at Geojit Financial Services, noted the market’s reaction, particularly the decline in sectors such as FMCG, banks, and auto. Weak Q3 results and downgrades in volume growth, attributed to subdued rural demand, exerted additional pressure on the FMCG sector.

Among the Sensex constituents, several major players experienced declines, including ITC, Kotak Mahindra Bank, and HDFC Bank, while others such as State Bank of India and Reliance Industries managed to post gains.

In global markets, Asian indices demonstrated mixed performance, with Seoul, Tokyo, and Shanghai closing higher, while Hong Kong concluded lower. European markets exhibited gains, and the U.S. markets closed positively on Wednesday.

The cautious stance adopted by the RBI in its latest policy decision was largely in line with market expectations, according to Parijat Agrawal, Head of Fixed Income at Union Asset Management Company Pvt Ltd.

Amidst these developments, global oil benchmark Brent crude saw a slight decline to $79.07 per barrel, while Foreign Institutional Investors (FIIs) offloaded equities worth ₹1,691.02 crore on Wednesday.